DOWNLOAD

DATE

Contact

Over the next five years, Southeast Asia’s data consumption and computing growth will require a massive investment (US $40-$60 billion) in infrastructure (towers, fiber, and data centers). Through the mix of telecom revenues and IT spending flattening, high interest rates soaring, and weak currencies across the globe, this is both a tall order and a huge opportunity for companies with the right strategy. This Viewpoint explores the path forward toward digital transformation.

THE OPPORTUNITY

The telecom landscape in Southeast Asia (SEA) is evolving rapidly, driven by increasing adoption of mobile devices and digital services. Data consumption in SEA is exploding, with mobile data traffic expected to grow at a CAGR of 32% from 2022–2028 (compared to 20%-25% in Western Europe from 2022–2030), according to reports by Ericsson and Arthur D. Little [ADL]), respectively.

5G networks are being rolled out at a rapid pace, and the technology is expected to reach 52% penetration in SEA by 2030 (from 2% in 2021), as highlighted in research from Fitch Solutions/BMI. Telcos in Singapore, Malaysia, Thailand, and Indonesia have already made significant investments in their 5G networks, and the need for additional towers to meet coverage requirements is likely to surge in the next few years.

The Southeast Asian population is both digital and mobile-native, with mobile penetration rates of 136% in SEA, according to DataReportal. Furthermore, SEA’s digital economy is expected to grow from $194 billion to $330 billion between 2022–2025 from increased e-commerce; food and transport; and online media, including social media, streaming, and gaming.

To successfully serve consumers and the growing needs of enterprises and governments (cloud ERP and cloud CRM, among others), the region will need more towers and substantially more local and regional data centers. Fiber is expected to underpin SEA’s data revolution. Fiber will support 5G connections between mobile towers and commercial sites, connections to and between data centers (fiber to the business [FTTB]), and high-bandwidth end-user applications (fiber to the home [FTTH]).

The mobile-first data revolution

Until now, mobile network operators (MNOs) have owned most towers in SEA countries. This ownership structure will change rapidly over the next five years, with new business models that emphasize seamless active network sharing gaining traction.

The average tenancy ratio of towers in SEA is 1.3, compared to global best practices of 1.7-1.9. This is primarily due to the high percentage of MNO-owned towers in the region and is expected to change rapidly. There has been steady acceleration in SEA’s tower market since 2019, and EDOTCO, a regional integrated telecommunications infrastructure services company based in Asia, recently acquired towers from multiple MNOs in Malaysia, including Celcom, Digi, and U Mobile.

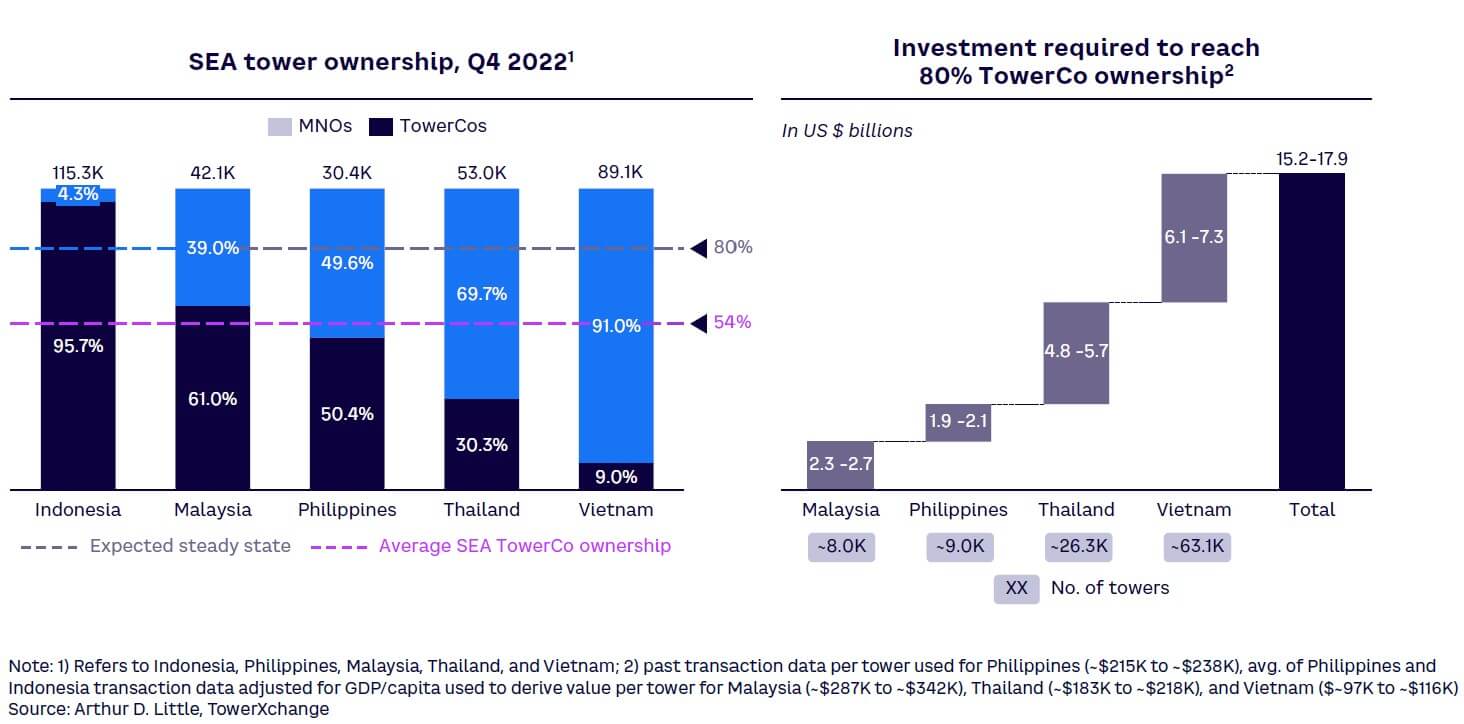

At the end of 2022, only 54% of the towers in the SEA region were owned by TowerCos (Indonesia is the exception), compared to 80% TowerCo ownership in advanced markets (see Figure 1). There are around 329,700 towers in SEA countries (Malaysia, Philippines, Thailand, and Vietnam represent 64%), many of which will be sold to TowerCos. For the market to reach 80%,106,500 towers across the remainder of the SEA nations would have to change ownership, at an estimated total transaction value of $15-$18 billion.

The highest volume of transactions is expected in Vietnam and Thailand (~3,100 towers in Vietnam and ~26,3000 towers in Thailand). Both countries reaching the expected 80% TowerCo ownership would involve an investment of $6.1-$7.3 billion in Vietnam and $4.8-$5.7 billion in Thailand, accounting for more than three-quarters investment potential of the region.

Understanding trade-offs & long-term impacts

Tower transactions are a complex matter that requires careful consideration of trade-offs to ensure the transaction value is appropriate, and no value is destroyed. TowerCos and MNOs must carefully evaluate factors such as site quality, lease terms, tenancy ratios, operational efficiency, market demand, and regulatory environment to determine the value of the infrastructure being acquired/sold. Both parties must also consider the impact of the deal on their long-term strategic objectives and potential risks. Failure to properly evaluate these factors could result in a suboptimal deal that destroys value for both parties. Thus, it is essential for TowerCos and MNOs to rigorously evaluate all aspects of these deals to ensure maximum value for stakeholders.

Although the key drivers of acquiring infrastructure from an MNO in SEA are similar to those in other regions, the deals in this case require specific attention, expert knowledge, and long-standing experience in the local market, including its conditions and regulations. For example, asset reconfiguration of the telco infrastructure in advanced markets can lead to higher efficiencies. New, longer-term business models will emerge, including radio access network (RAN) companies to facilitate even more seamless active network sharing.

FIBER: THE FOUNDATION OF THE DIGITAL INFRASTRUCTURE

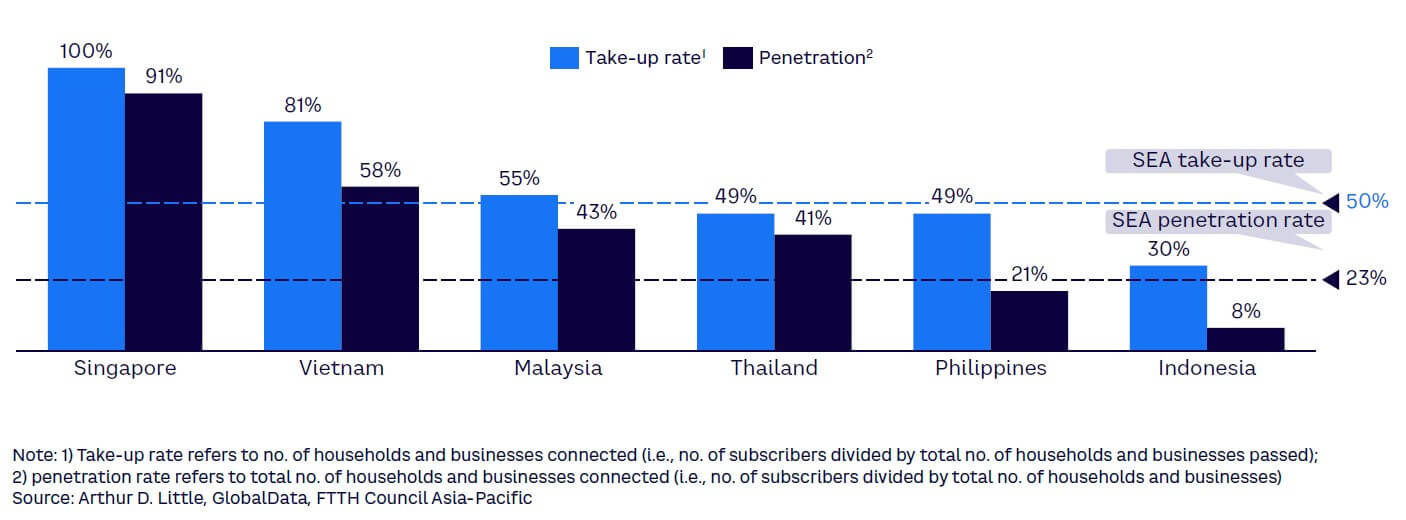

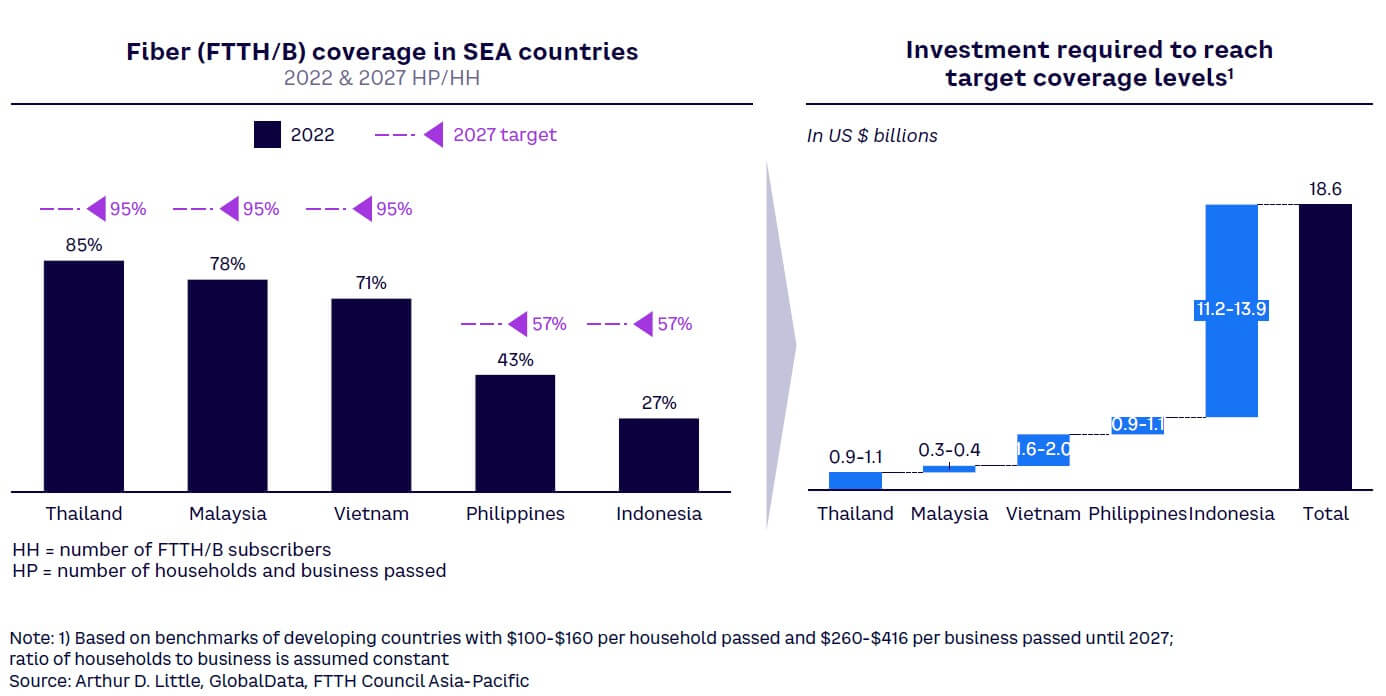

Fiber-penetration rates are on the rise in SEA, driven in part by national governments (see Figure 2). Extensive fiber build-out in the region is anticipated over the next five years, costing $15-$18 billion:

-

In August 2020 in Malaysia, the prime minister announced the action plan JENDELA (Jalinan Digital Negara). Valued at $4.7 billion, the plan aims to steer Malaysia toward better digital connectivity by boosting infrastructure nationwide. The goal is to have 9 million premises with gigabit speed by 2025.

-

In Thailand, the Digital Economy and Society Development Plan calls for an FTTH penetration to 75% of households by 2027.

-

In Singapore, government initiatives to promote competition and innovation in the telecom sector led to several new FiberCos emerging and a drastic reduction in the cost of fiber connections to the home. Singapore’s success has become a benchmark for other decision makers: the passive fiber infrastructure it rolled out as part of its National Broadband Network plan has been successful in ensuring nearly 100% fiber coverage of all premises.

-

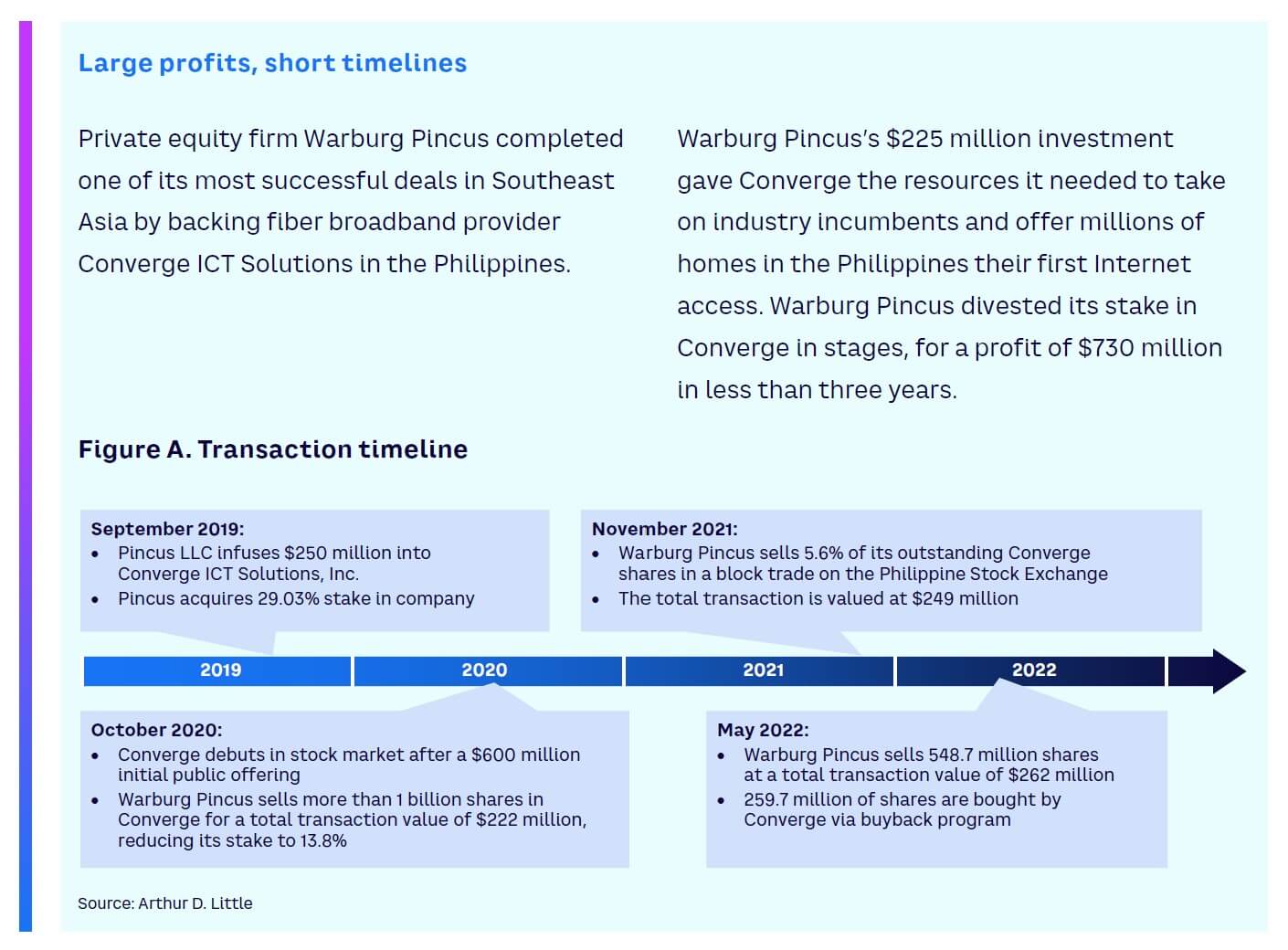

In the Philippines, a recent investment in Converge ICT Solutions by private equity firm Warburg Pincus highlights the potential for independent FiberCos to drive infrastructure development (see sidebar “Large profits, short timelines”).

-

Vietnam’s growing demand for high-speed Internet and the government’s commitment to infrastructure development are creating an attractive investment landscape.

-

Indonesia’s government is pushing for increased fiber coverage led by telcos and Internet service providers, but the country’s topography presents unique challenges to fiber deployment.

-

In 2022, Big Data Exchange (BDx) formed a new data center joint venture in Indonesia together with Indosat Ooredoo Hutchison and its subsidiaries, IT firm Lintasarta and telecom company Starone Mitra Telekomunikasi, to establish a new data center and cloud-focused operation in Indonesia. The agreement is valued at $300 million and marks BDx’s entry into Indonesia’s data center market.

ADL’s estimates for fiber investment for each country are based on current coverage levels, announced government ambitions (wherever available), and benchmark targets for coverage (where government ambitions are not available).

Based on the FTTH/FTTB coverage targets, SEA presents an investment opportunity of around $19 billion by 2027 for fiber infrastructure (see Figure 3), with 75% of that investment estimated in Indonesia due to low coverage levels.

Fiber value considerations

Value creation in the fiber business requires understanding the perspectives of both investors and operators. Investors are looking for a financially viable business case that offers long-term stable returns. Fixed players are focused on creating value for their customers, maximizing their network utilization, and optimizing their costs. Value creation is highly dependent on local market structure, as major trade-offs must be optimized for fixed infrastructure assets (see ADL Viewpoint “Navigating Fixed Asset Reconfiguration in Telcos”).

SEA’s fiber landscape presents significant opportunities for investors. To succeed, they must adopt a comprehensive approach that leverages market insights, regulatory analysis, and industry expertise. Through careful assessment of market potential, the competitive landscape, and the regulatory environment, investors can identify the most promising opportunities. It’s also essential to recognize the potential impact of disruptive technologies and business models on the telecom sector and plan accordingly.

SEA DATA CENTERS: RIDING THE WAVE OF DIGITAL TRANSFORMATION

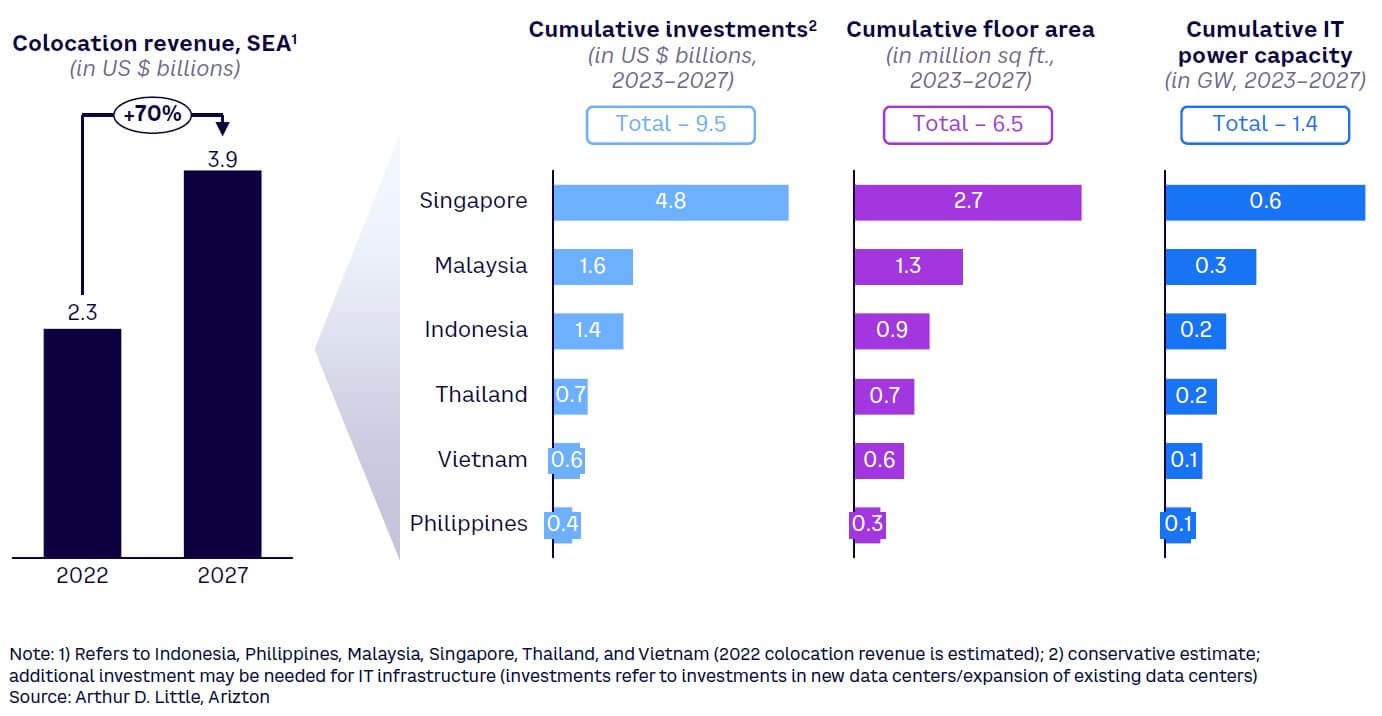

As digital transformation sweeps across SEA, the data center colocation market is riding a wave of growth, set to expand by 70% from 2022 to 2027 (see Figure 4). Twenty new data centers are expected to open by 2027, resulting in 6.5 million square feet of additional floor area. A total investment of $9.5 billion is expected in the region between now and 2027.

Understanding the market

Based on the expected number of data center build-outs and investment announcements by hyperscalers, it would seem logical to be bullish on this market. However, unlike recent high-value tower transactions in SEA, data center investment returns have been mixed. They have been hampered by overbuilding and/or subpar assets. Location, energy and infrastructure reliability, climate conditions, and government regulations all play a role in ROI.

In the past, the key questions related to a data center build have been “what,” “who,” and “where.” Going forward, the “who” question must be answered first, and pre-marketing investments must be substantial:

Understanding market segment (“who”)

- Retail:

-

Focus on local customer needs in outsourcing data. Customers want their data to be safe and easy to access, and they prefer to use a nearby provider.

-

As customers interact across borders, follow their demand by opening facilities that address those needs. Retail starts locally and becomes regional through its platform play.

-

- Wholesale:

-

Offer the lowest-possible price and play up your flexibility to attract larger private cloud and hosting players that resell this space to their customers.

-

Develop key account managers to tackle this segment and drive volumes rapidly, as these will bring in multiple-MW capacity.

-

- Hyperscaler:

-

This market segment has detailed build-out requirements, requesting upward of 10 MW of capacity when leasing with a third-party data center operator.

-

US-based hyperscalers (AWS, Google, Meta) traditionally preferred to build their own facilities, but this is changing as speed to market becomes essential in offering cloud services to end users.

-

Asia-based hyperscalers like Alibaba work with a specific set of providers, capturing large volumes of their capacity.

-

Risks of customer concentration can be offset by building strong, trusted relationships.

-

Building high-quality assets focused on energy efficiency & sustainability (“what”)

-

Tier 3 construction quality is the minimum standard customers will accept (hyperscalers bring their own requirements).

-

Be carrier-neutral to offer sufficient connectivity options for customers.

-

Colocation density is a key point to drive higher space utilization for higher revenue potential.

Considering government & regulatory support (“where”)

-

Location decisions should be based on the answers to “who” and “what.”

-

The degree to which government support and regulatory ease exist should also be considered. In SEA, the leading areas are Singapore, Malaysia, and Indonesia; the next hot spots are in Thailand, Vietnam, and the Philippines.

Conclusion

SEIZE THE OPPORTUNITIES

Digital infrastructure opportunities in Southeast Asia are rising and expected to surge, with somewhere between $40-$60 billion in investments required. Takeaways to consider are:

-

Telecoms. Post-market consolidation and high interest rates mean telcos may find it difficult to fund their own build-outs. They may need to redesign their asset ownership and business models in both fixed and mobile. Fixed asset reconfigurations and tower ownership will change rapidly across markets, and new business models (e.g., RAN companies) are likely to emerge.

-

Independent TowerCos and data center owners/operators. These entities should consider the next five years as the last big-build opportunity and pivot toward technologies and funding approaches that ensure profitable participation.

-

Investment funds. Decision makers should aggressively engage in this opportunity using flexible, nuanced investment approaches.